Paylocity paycheck calculator

Ad Weve Done the Research Browse the Payroll Shortlist Find a Better Solution Today. Common features include calculating employee wages subtracting withholdings and.

Paylocity Reviews Prices Ratings Getapp Canada 2022

Check the Remember My Username box to.

. Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Start setting up Gusto for free and dont pay a cent until youre ready to run payroll. California Hourly Paycheck Calculator.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. All calculators are automatically updated as payroll laws and tax tables change. Ad Start setting up Gusto for free and dont pay a cent until youre ready to run payroll.

Enter the Paylocity assigned Company ID. Determine your taxable income by deducting pre-tax contributions Withhold. For example if an employee makes 25 per hour and.

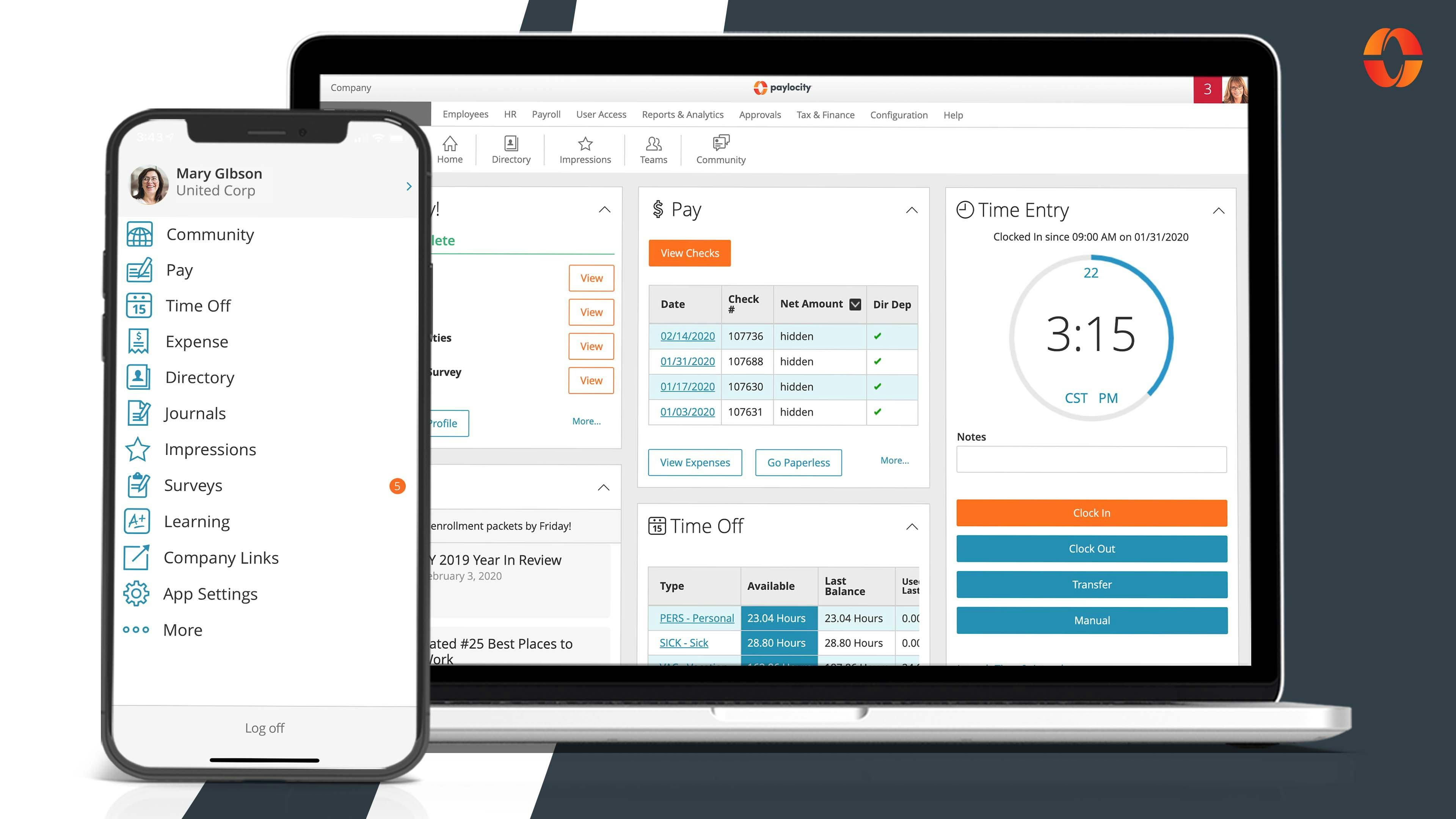

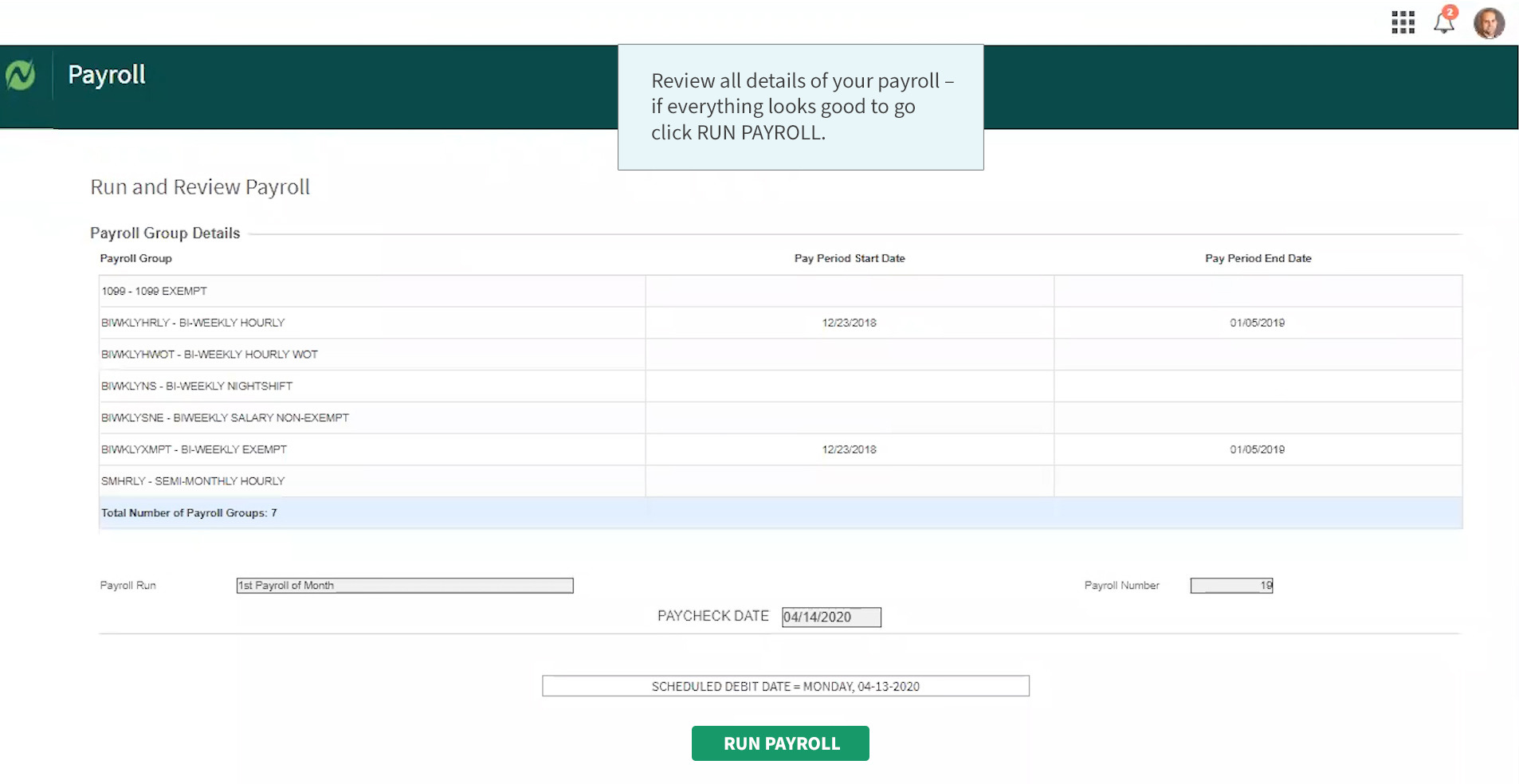

Receipts and reimbursement requests can pile up quickly. Its a simple four-step process. Ad Process Payroll Faster Easier With ADP Payroll.

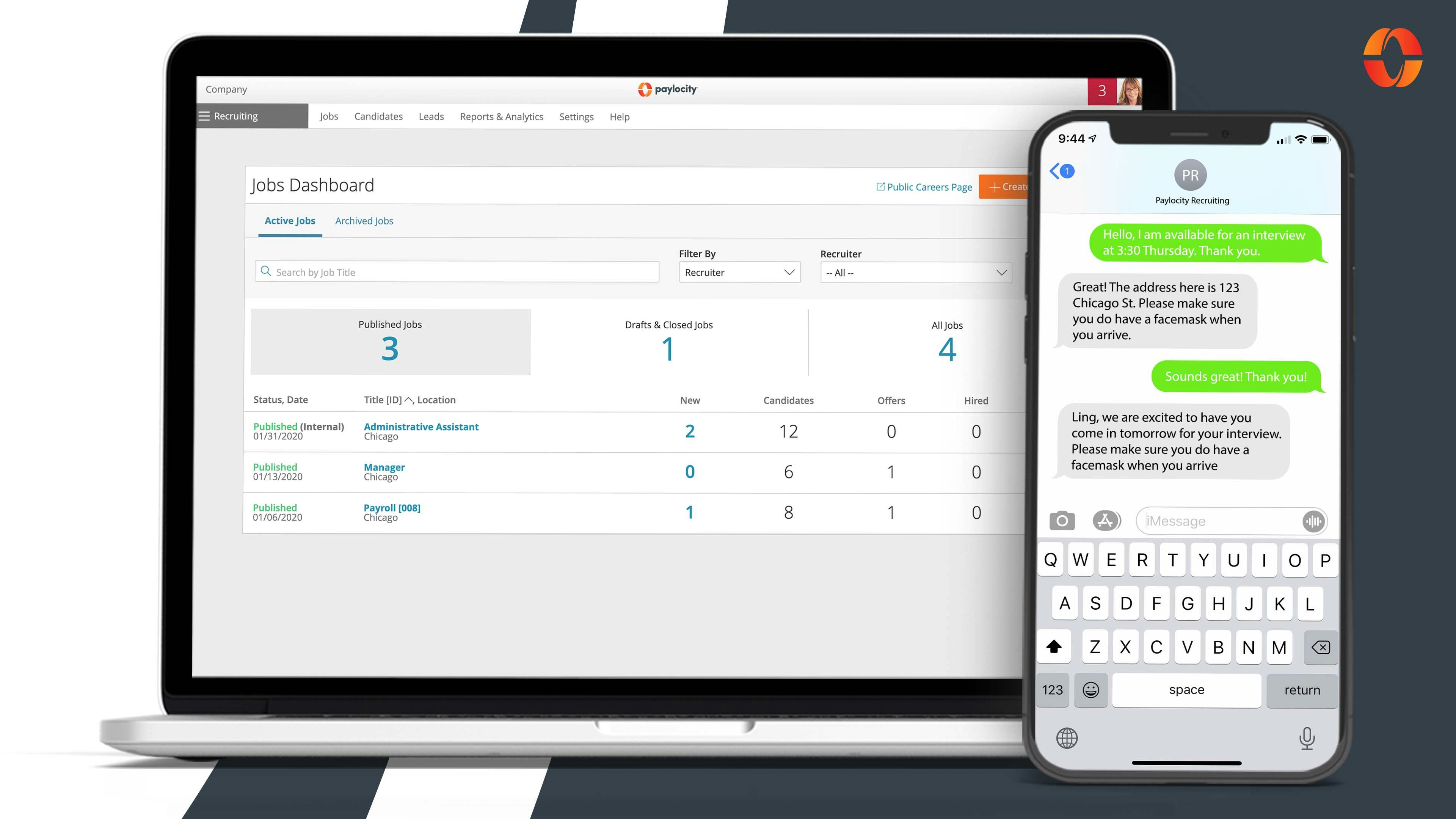

Payroll software is a digital payroll solution for managing and automating the employee payment process. We use the most recent and accurate information. Payroll Is Not Easy but Weve Got the Process down to a Fast and Easy Job.

Multiply the hourly wage by the number of hours worked per week. Ad Compare Prices Find the Best Rates for Payroll Services. Streamline your payroll benefits onboarding and integrations all in one place.

Finding a New Payroll Solution Can be Complex But It Doesnt Have to Be. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck. Ad Shouldering the Burden of Doing Payroll Can Distract You from Your Main Duties.

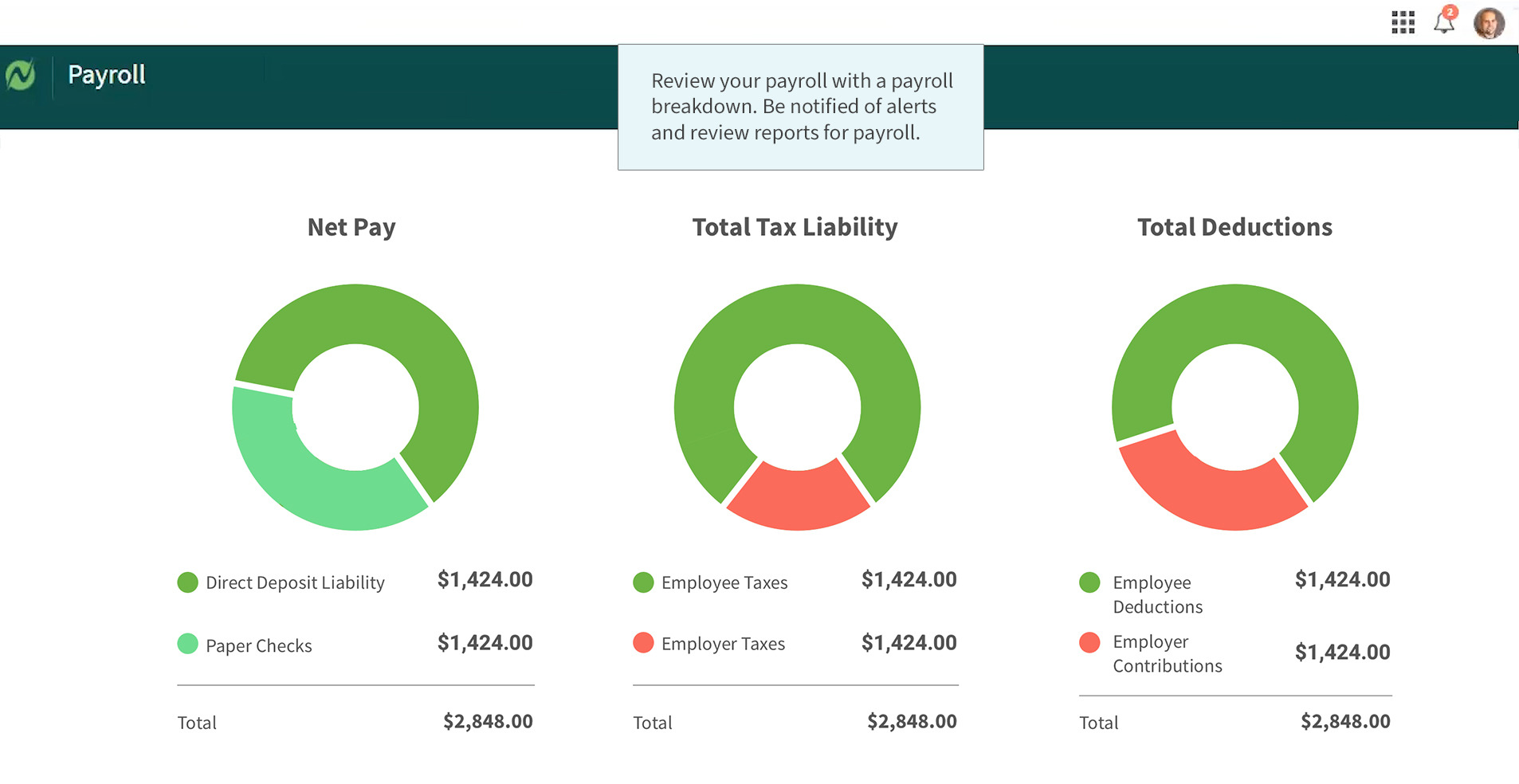

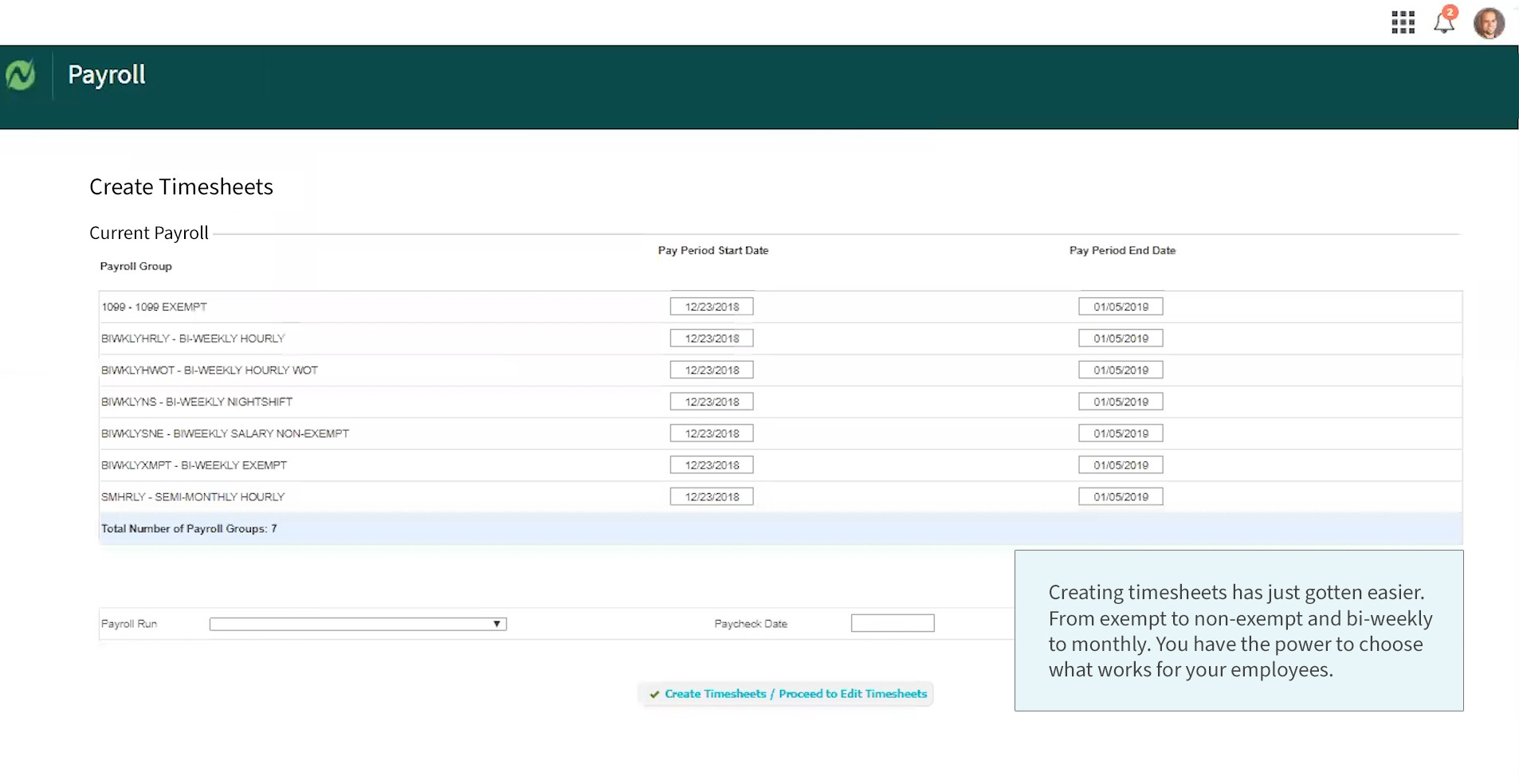

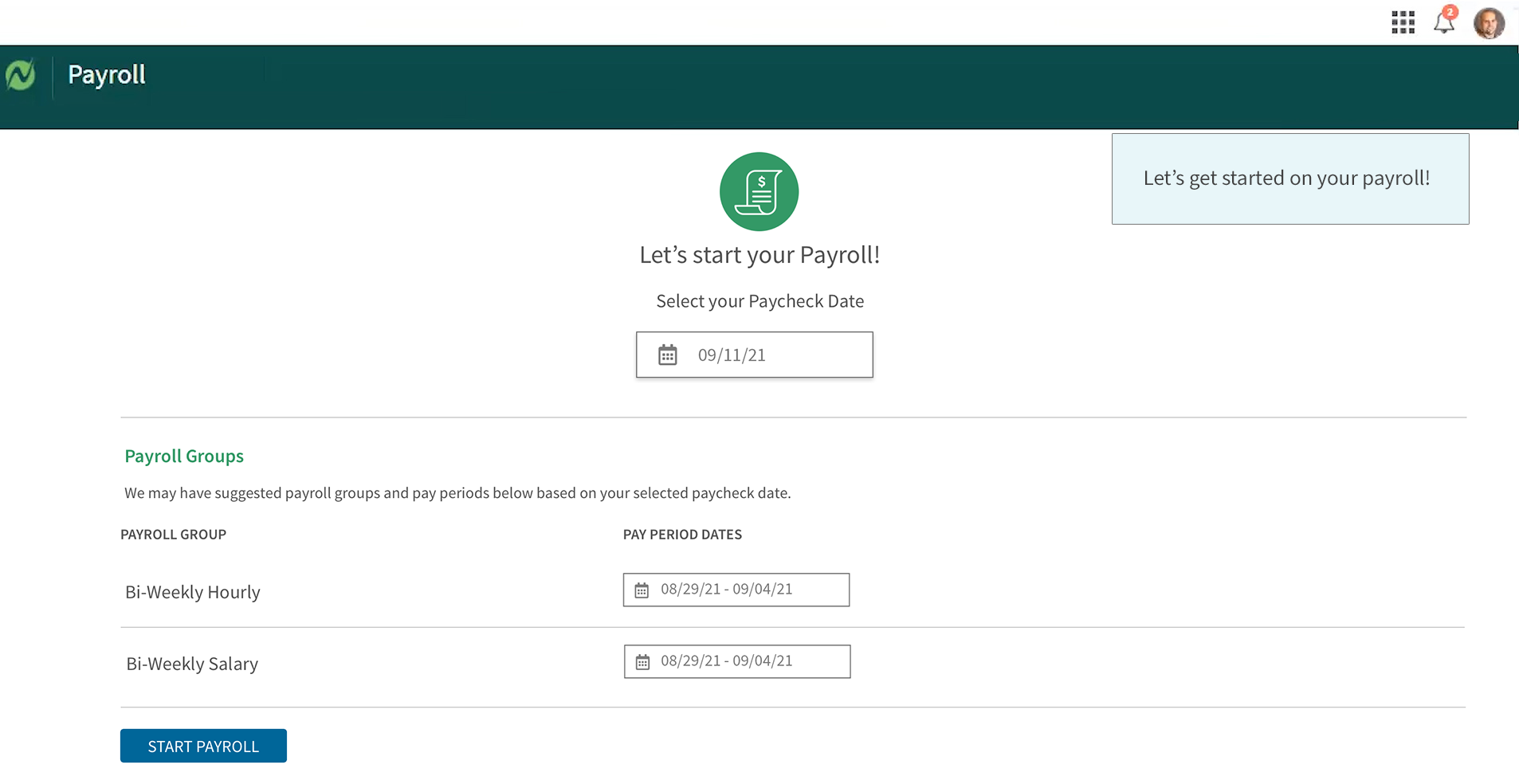

Netchex offers a robust collection of financial calculators that are free and easy-to-use. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Use your companys customized reason codes for merit increases one-time bonus payments cost of living increases and more.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Paylocity pays its employees an average of 77662 a year. Then multiply that number by the total number of weeks in a year 52.

All Services Backed by Tax Guarantee. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross. It includes calculating their wages withholding taxes and employee benefits.

Make Your Payroll Effortless and Focus on What really Matters. Use this federal gross pay calculator to gross up wages based on net pay. Get Started With ADP Payroll.

One of the most useful and sought after this paycheck calculator quantifies take-home pay for salaried employees. Our expense tracking tool makes it easy to process expenses with ease and accuracy and without the paperwork. By accurately inputting federal withholdings allowances and any relevant.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty. Salaries at Paylocity range from an average of 44321 to 134336 a year. Streamline your payroll benefits onboarding and integrations all in one place.

How much does Paylocity pay. Compensation management data and insights provide. A paycheck calculator allows you to quickly and accurately calculate take-home pay.

Ad Create professional looking paystubs. In a few easy steps you can create your own paystubs and have them sent to your email. ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdown into hourly daily weekly monthly.

Texas Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Payroll process is the process of compensating your employees for the work they perform.

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

The Hourly Paycheck Calculator Netchex

Paylocity Reviews Prices Ratings Getapp Canada 2022

Paylocity Understanding Your Paycheck Edocr

Paylocity Review Pricing Pros Cons Features Comparecamp Com

Hourly Paycheck Calculator Primepay

Paylocity Software Reviews Alternatives

Paycheck Calculator Netchex Payroll Software

Paycheck Calculator Netchex Payroll Software

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Paylocity In 2022 Reviews Features Pricing Comparison Pat Research B2b Reviews Buying Guides Best Practices

2

The Hourly Paycheck Calculator Netchex

Free Payroll Tax Paycheck Calculator Youtube

Calculate Your Paycheck With Paycheck Calculators And Withholding Calculators Paycheckcity

The Hourly Paycheck Calculator Netchex